Health Tech Primer for Europe: the state and future of technology in European healthcare

Deep dive, Christoph Ruedig

Throughout 2020 and 2021, healthcare has been at the forefront of almost every agenda: public and private, company and government, young and old. Much of it, of course, driven by the worst pandemic in generations. We at AlbionVC have been investing in healthcare and technology in Europe for over two decades and never have we experienced anything like this before. The stories we’re hearing from our companies on the frontlines of healthcare every day make it clear that the industry is undergoing the most monumental shift of modern times. We therefore thought it would be good to take stock, look at what’s happened and share our thoughts on the state and future of healthcare technology in Europe (that is, including the UK).

This is the first of a series of releases by AlbionVC on European health tech and provides a high level overview of what has happened over the last 10 years. In the future, we will be diving into details of various subsectors such as chronic care, AI drug discovery, etc. – all viewed from a European lens.

Deep tech and economics – the case to be bullish about healthcare

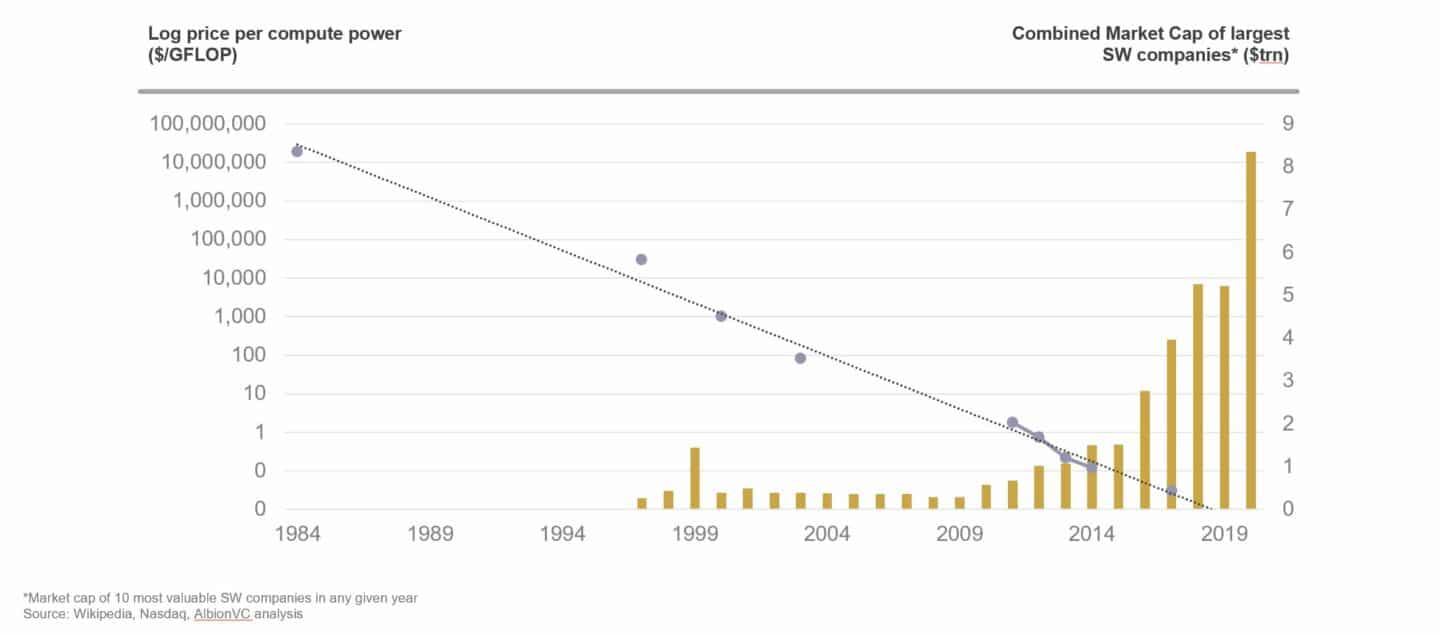

First, lets take a step back and look at the broader technology industry. Most “techies” know the phrase coined by Marc Andreessen “Software is eating the world”. Most will also know Moore’s Law, a rule that can be interpreted as the price of compute power dropping by half every two years. The chart below overlays the price of compute power with the growth in the value of technology companies over the last 25 years.

This is economics 101: as the price of something drops, mass adoption follows and significant markets are being created. Now let’s plot the price of genome sequencing against the price of compute power.

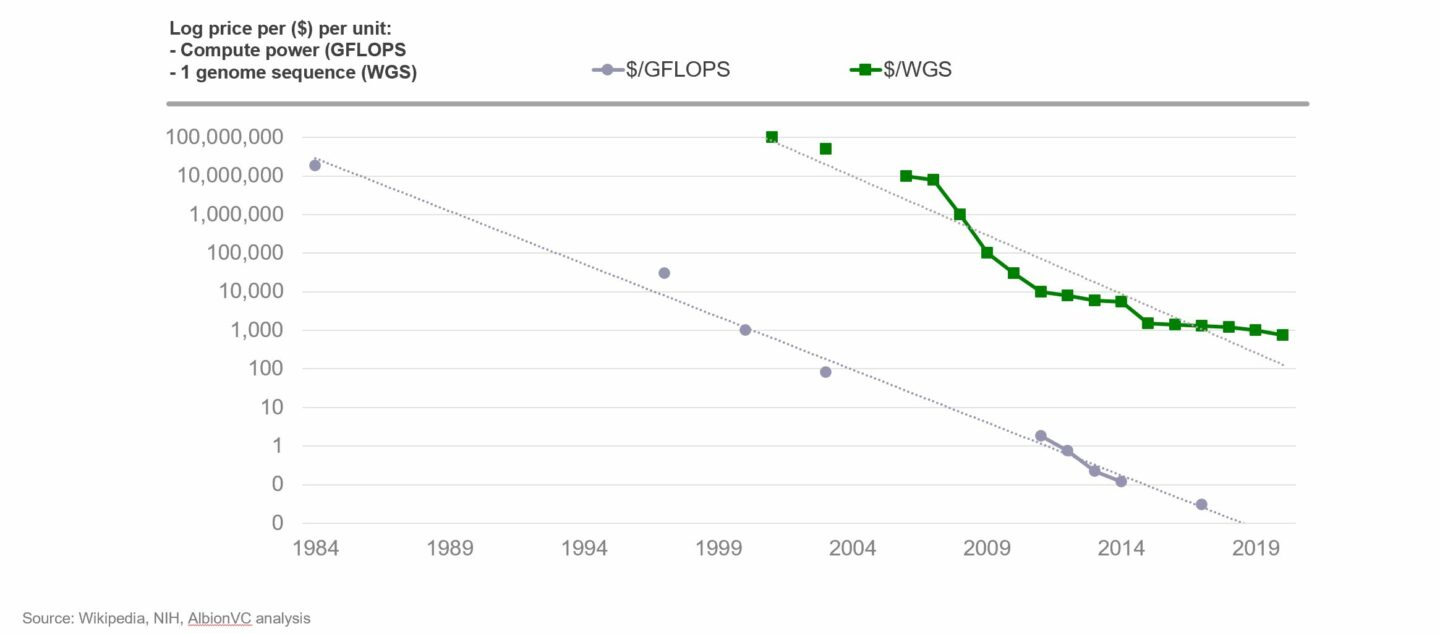

A striking similarity of fundamental drivers – we believe this dynamic, also seen in other technologies with this profile, will underpin a similar growth in value in health technology companies over the next decade and beyond.

The first genome was sequenced in the year 2000, after >10 years and at a cost of $3bn – literally off the chart. That cost has recently come down to <$1,000, though the decrease hasn’t been a straight line with periods of rapid deceleration ~15 years ago (driven by technology invented at Solexa, a British deep tech firm) followed by a period of slower decline recently. The prediction is that new technologies (such as that from Oxford Nanopore, another British deep tech firm) will bring the cost curve down further and further.

The decrease in the cost of genome sequencing has already had a profound impact by vastly enriching our knowledge on the genetic causes of diseases including cancer, which has led to the cell and gene therapy (CGT) revolution that is currently taking the biotech world by storm. We know from many investments in CGT companies, and the work we’re doing at the UCL Technology Fund, that science is just scratching the surface and that there’s so much more to come.

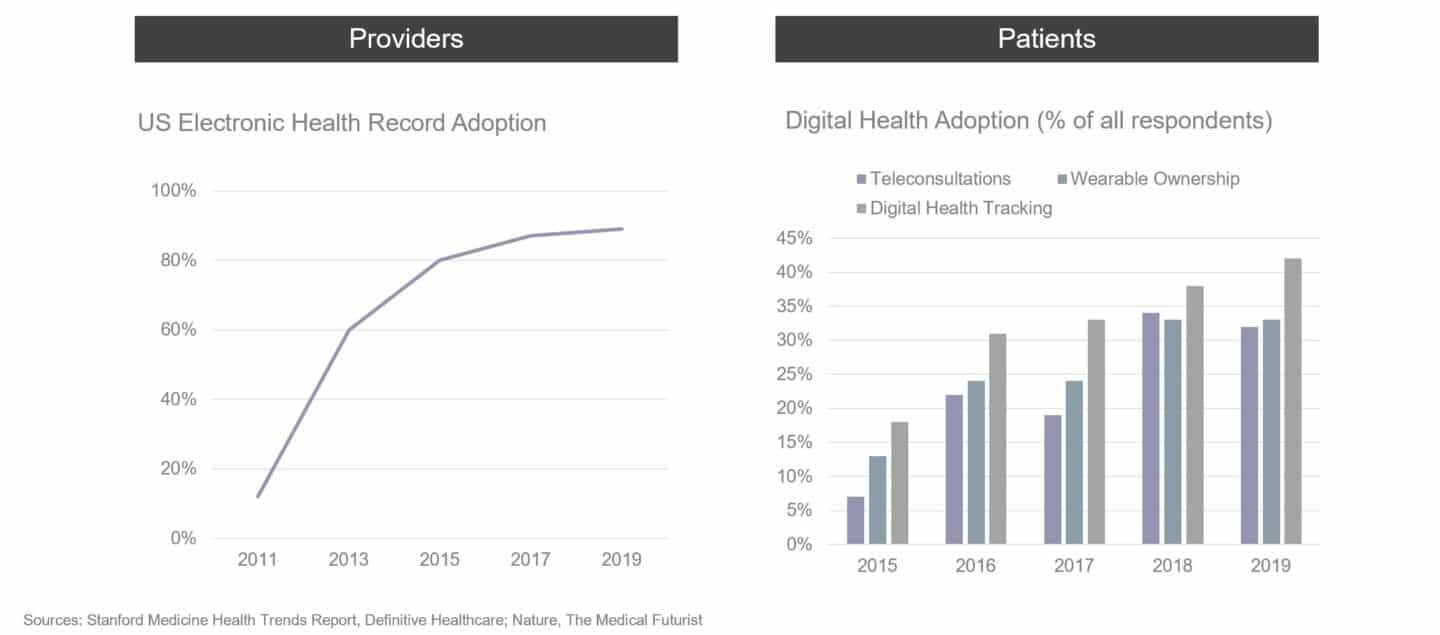

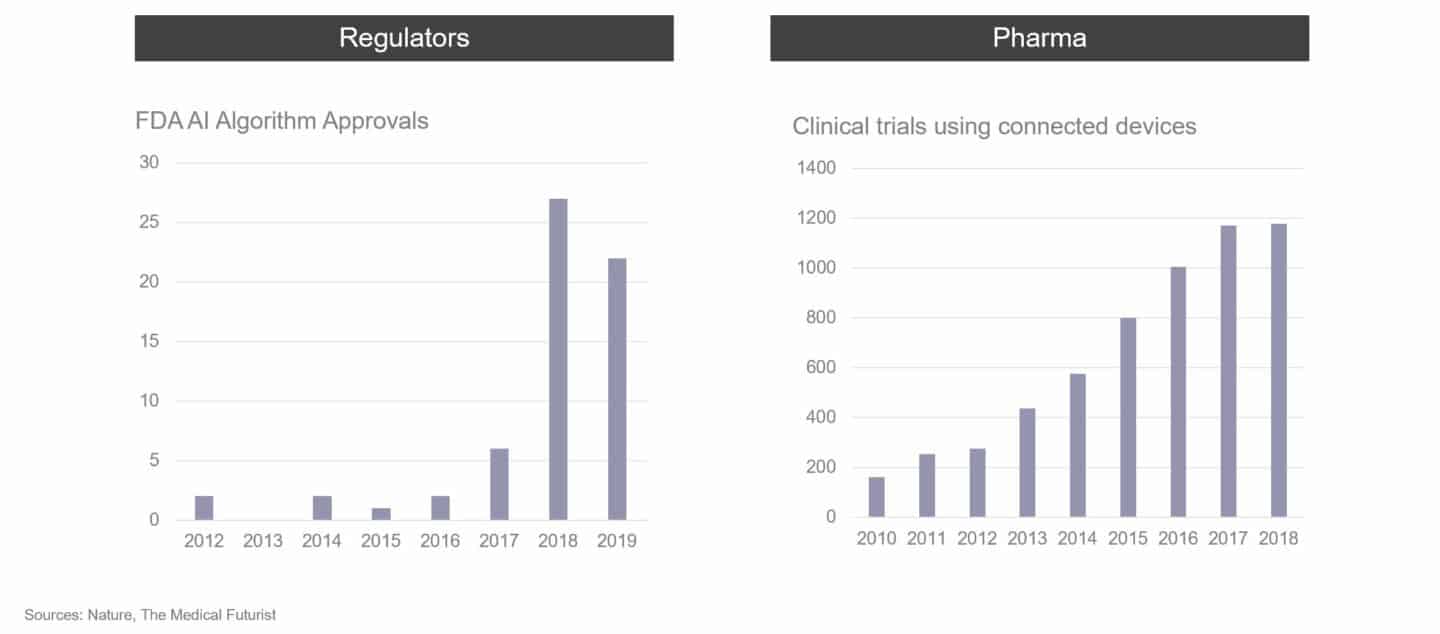

Pre-Covid: Slowly but steady

The previous chart picks out one area in healthcare (genomic medicine) where cost decreases and broad-based adoption are driving substantial change and progress. Similar dynamics are at play in other areas with the rise of mobile devices, cloud computing, AI and the internet of things all permeating different parts of healthcare. These technology innovations have happened at a time that has seen a few big secular shifts such as the “consumerisation” and personalisation of healthcare, economic stagnation and an ageing population; as well as significant advances in our understanding of biology and disease following the genomics revolution described above. The result has been a slow but steady increase in the adoption of digital technology in healthcare pre-Covid-19. The charts below show a few examples of what has happened over the last 5-10 years for four different healthcare stakeholders: patients, providers, regulators and pharma.

In certain areas of healthcare, considerable momentum was already starting to build with a shift to digital in the middle of the last decade. The most notable areas were chronic conditions such as diabetes and heart disease where companies like Livongo, Omada Health and Virta Health were starting to change entrenched practices and showing early signs of broad-based adoption pre-pandemic. However, the early successes were mostly confined to the USA whereas Europe continued to move very slowly.

A long way to go (and grow)

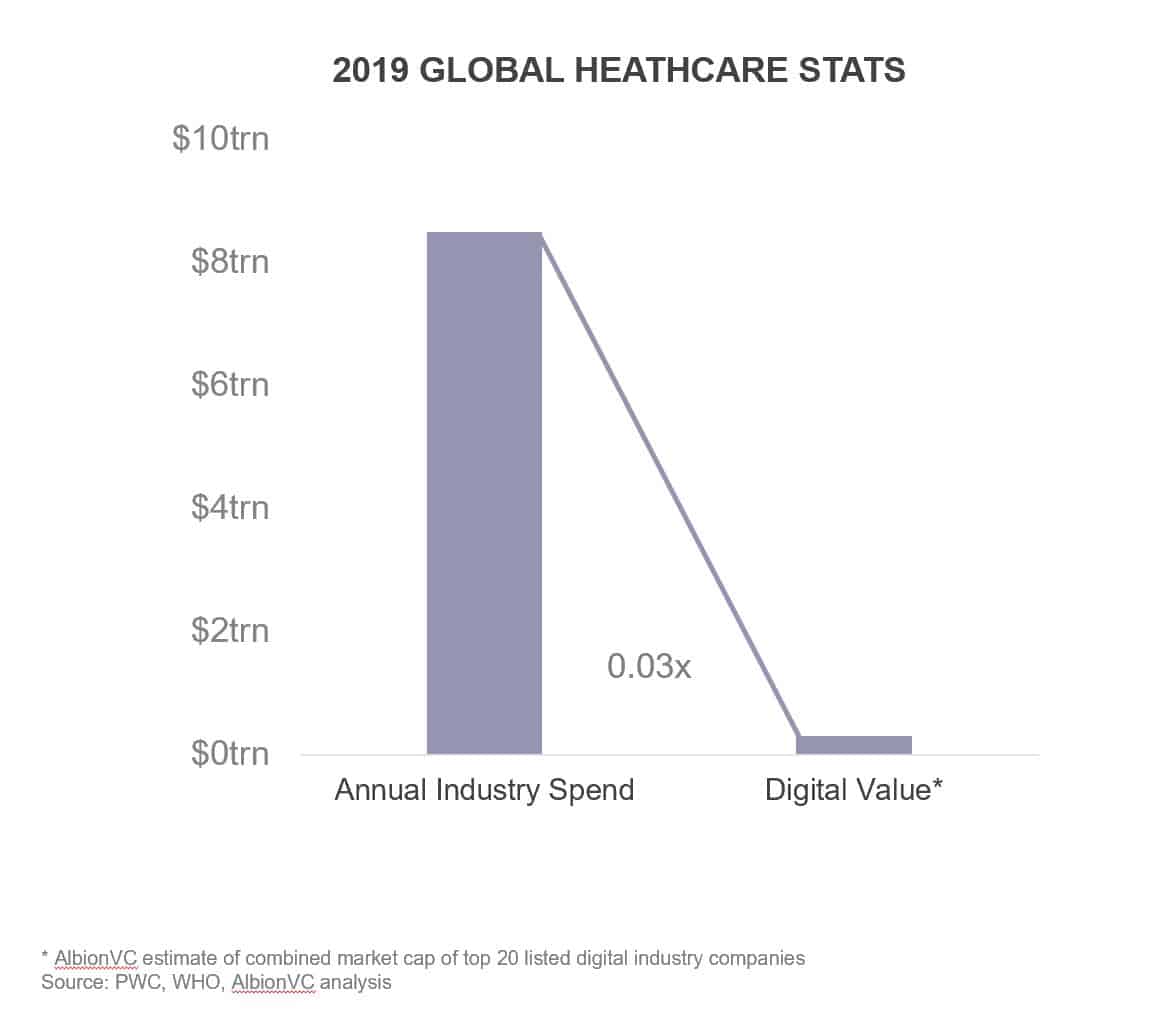

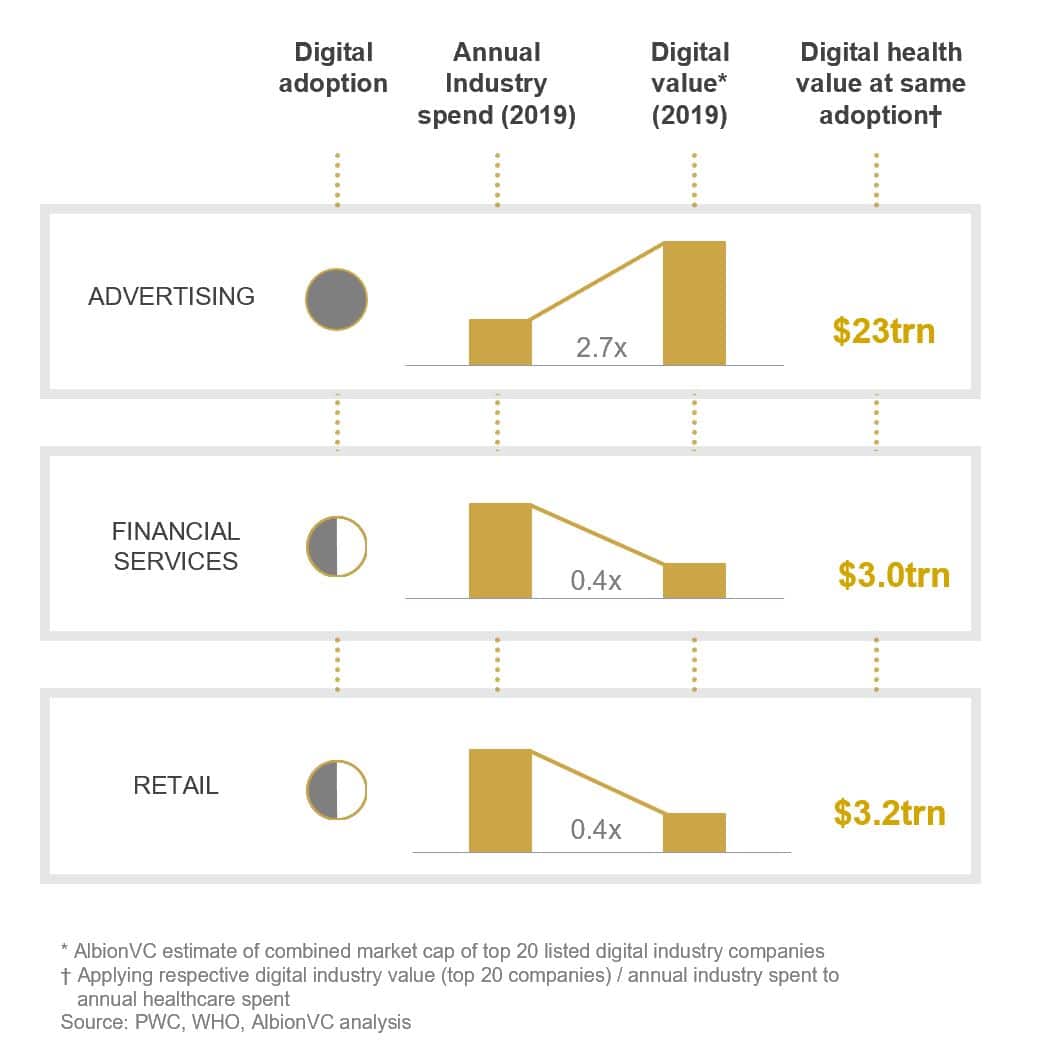

As venture capital investors, we take a long-term view. To start to understand where technology in healthcare is today and where it could go, it helps to look at other industries that have been disrupted by technology. The chart below compares the global size of the healthcare industry (in money spent per year) to the combined market cap of the largest digital health companies in 2019 (before Covid-19 became pandemic).

What the chart makes clear is that the value of the largest digital health companies in 2019 was roughly 3% of the annual spend on healthcare. Making the same comparison for other industries shows how small the digital health industry was in 2019.

In advertising, which has been heavily disrupted by digital, the value of the largest technology companies exceeded total annual spend by a factor of 2.7 in 2019 according to our analysis. In financial services and retail, the ratio was 0.4 but trending upwards. So in healthcare, the ratio is less than a tenth of retail and financial services and almost one hundredth of advertising. Let’s be clear, we’re not saying that all of healthcare can be digitised – a seriously ill patient still needs to be treated on ICU – but there’s a lot of room for growth.

We’re seeing evidence of the enormous potential in some of the recent telehealth success stories in the USA such as Teladoc and Livongo, the former a remote teleconsultation service focused on primary care, the latter a platform for remote support of chronic diseases that started in diabetes. Adoption of technology enabling remote diagnosis and treatment has been given a boost by the Covid-19 pandemic, with Livongo’s diabetes patient numbers having grown >100% by mid-2020 to over 400,000. Livongo is by far the largest diabetes platform, yet there are over 30 million diabetes sufferers in the US and almost 90 million with pre-diabetes so digital penetration levels are still vanishingly low.

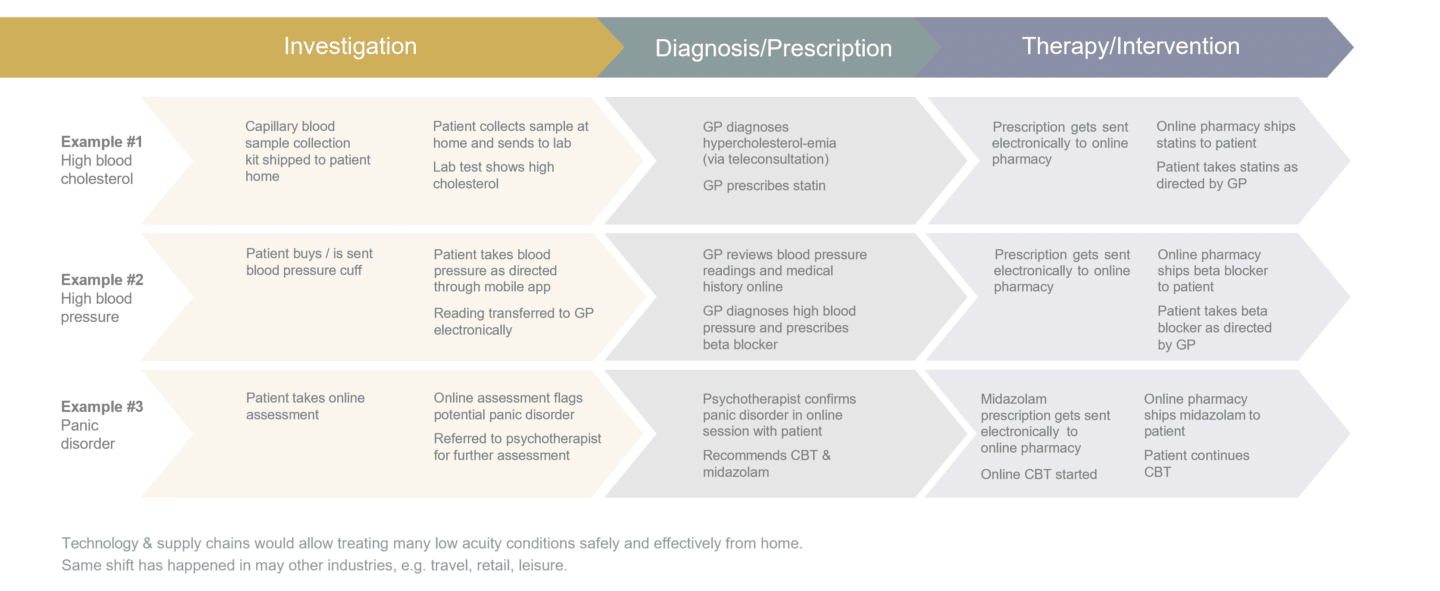

Come to think of it, much of the care in chronic conditions could in reality be delivered remotely. Let’s take the example of type 2 diabetes. The disease is monitored on the basis of elevated blood sugar levels or its effect on haemoglobin as measured by HbA1c. Anyone can buy a blood sugar meter in the pharmacy and you can get your HbA1c home testing kit from companies such as Thriva in the UK and CeraScreen in Germany. Treatment typically starts with weight loss therapy, for which there are remote providers such as AlbionVC portfolio company Oviva. If weight loss is not sufficient to achieve the desired control, oral anti-diabetic drugs are typically prescribed. These can be delivered to the patient’s home through one of the many online pharmacy services. So, perhaps with the exception of the initial diagnosis and health assessment, the entire type 2 diabetes patient journey, incl. primary care consultations can already be delivered fully remotely today.

The same is true of many chronic or even acute conditions. The graphic below gives 3 further examples of how investigation, diagnosis and treatment can be delivered remotely using technology.

A centuries old problem

Most people in the industry would answer the question of why healthcare has been a technology laggard by giving one or more of the following reasons:

- The industry is highly regulated

- Providers are dealing with very sensitive information

- There are complex stakeholder dynamics

- Biology is hugely complex

All of these are true. In fact, we have written about them in 2018: The Doctor will Facetime you now | AlbionVC

However, the lightning-fast adoption of technology across healthcare in the wake of the Covid-19 pandemic has shown that, in fact, the main problem has been inertia.

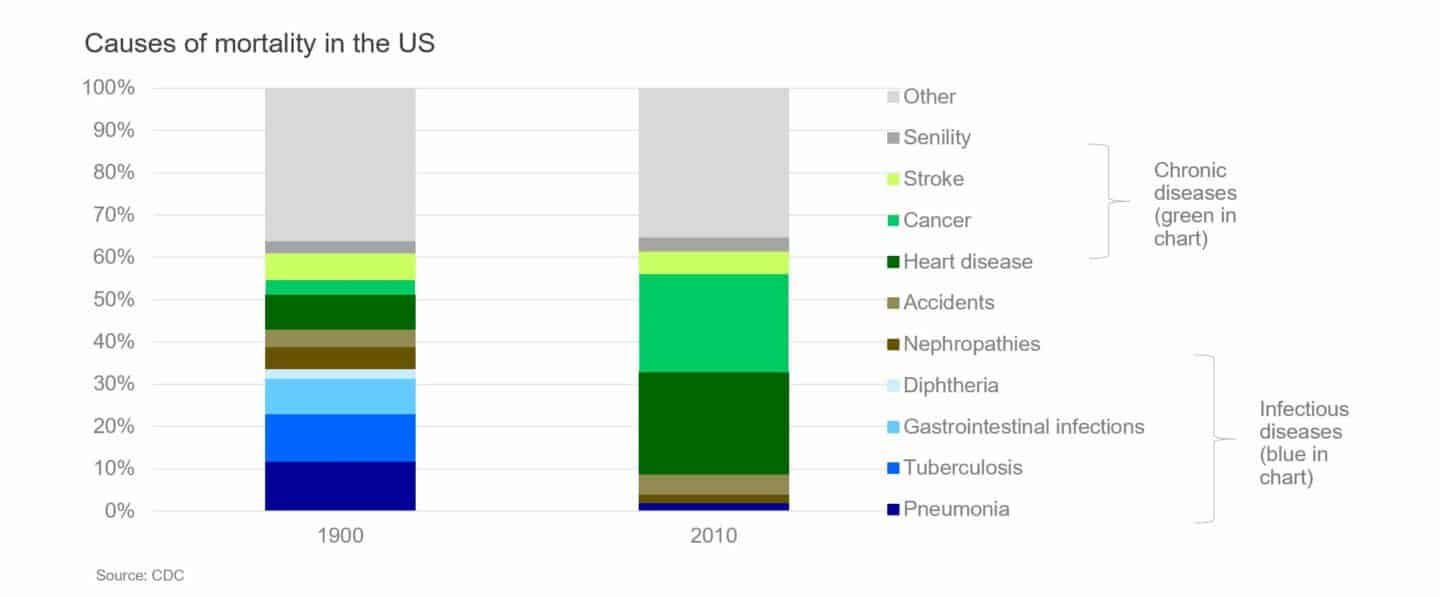

When trying to look into the future, it sometimes helps to look into the past. The way healthcare is delivered today has its origins in the late 19th and early 20th centuries. This was when effective treatments were first discovered for bacterial infections, making surgery much safer and allowing effective treatments of some of the deadliest diseases at the time. It was also the time when the first countries in Europe introduced public health insurance schemes. The chart below compares mortality causes at the turn of the last century with today (numbers are for the USA as the data is cleaner but the picture is similar in Europe).

The main disease burden in the late 19th and early 20th century was from nosocomial infections such as pneumonia, tuberculosis and diarrhoeal diseases. These are (mostly acute) conditions that either resolved quickly following treatment or were fatal. Also, there were virtually no treatments for chronic conditions at the time. A system of primary and secondary care facilities that house the technology and staff to quickly diagnose and aggressively treat acute conditions works well for such a world.

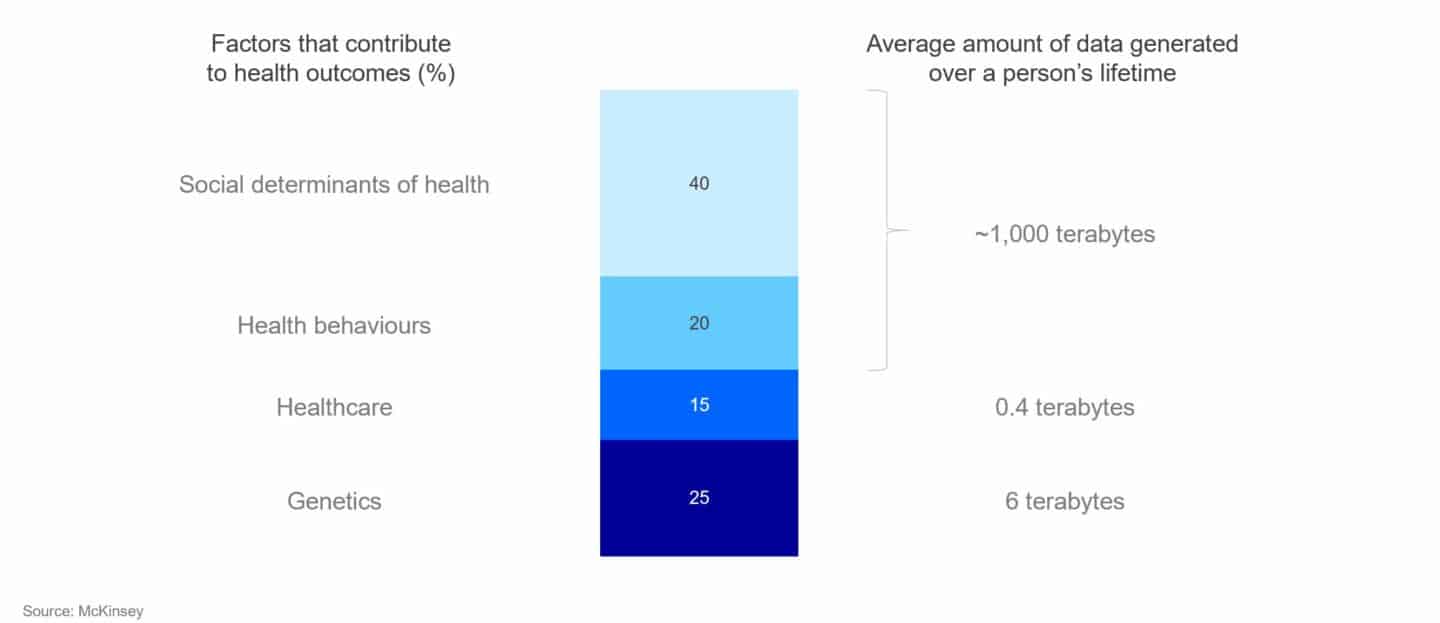

Fast forward to the early 21st century with the main disease burden from chronic conditions that require frequent diagnostic and therapeutic interventions, and, because of their complex nature, often a multidisciplinary approach. Also, many of the major chronic diseases require a high level of patient compliance and behaviour change. In this world, expensive secondary and tertiary care centres do a lousy job providing good outcomes at reasonable cost. If one was to design a healthcare system from scratch today using available technology, it would look very different indeed. It would probably be focused on identifying risk factors early (either at home or in low acuity primary care centres), monitoring them (remotely) and focusing interventions on behaviour change. McKinsey’s powerful analysis below backs this up, showing the factors that contribute to health outcomes today (as well as the data related to those factors).

So if health behaviours and social determinants contribute more strongly to outcomes than healthcare and we wanted to optimise for outcomes, we should therefore be focusing interventions on behaviours and social aspects. Alas, often the first intervention is a visit to the catheter lab to remove a coronary obstruction. It’s not that people don’t want to do more in prevention, it’s that the system isn’t geared to provide it well.

Which brings us back to Covid-19.

The moment of disruption

An area where prevention has actually worked extremely well is vaccines. The childhood vaccination programs that were put in place over the course of the 20th century have been highly effective at preventing severe diseases in children and have helped drive down childhood mortality considerably. Vaccines aren’t treatments – they are given to train your immune system to prevent infections. In the case of the highly successful mRNA vaccines against Covid-19, these were actually developed to train the immune system to fight cancer – luckily it turned out they are very good at training our immune system to fight SARS-Cov-2. The speed at which these and other vaccines were developed speaks to the forces that a major crisis can unleash on individuals, entrepreneurs, communities, companies all the way up to governments and their agencies.

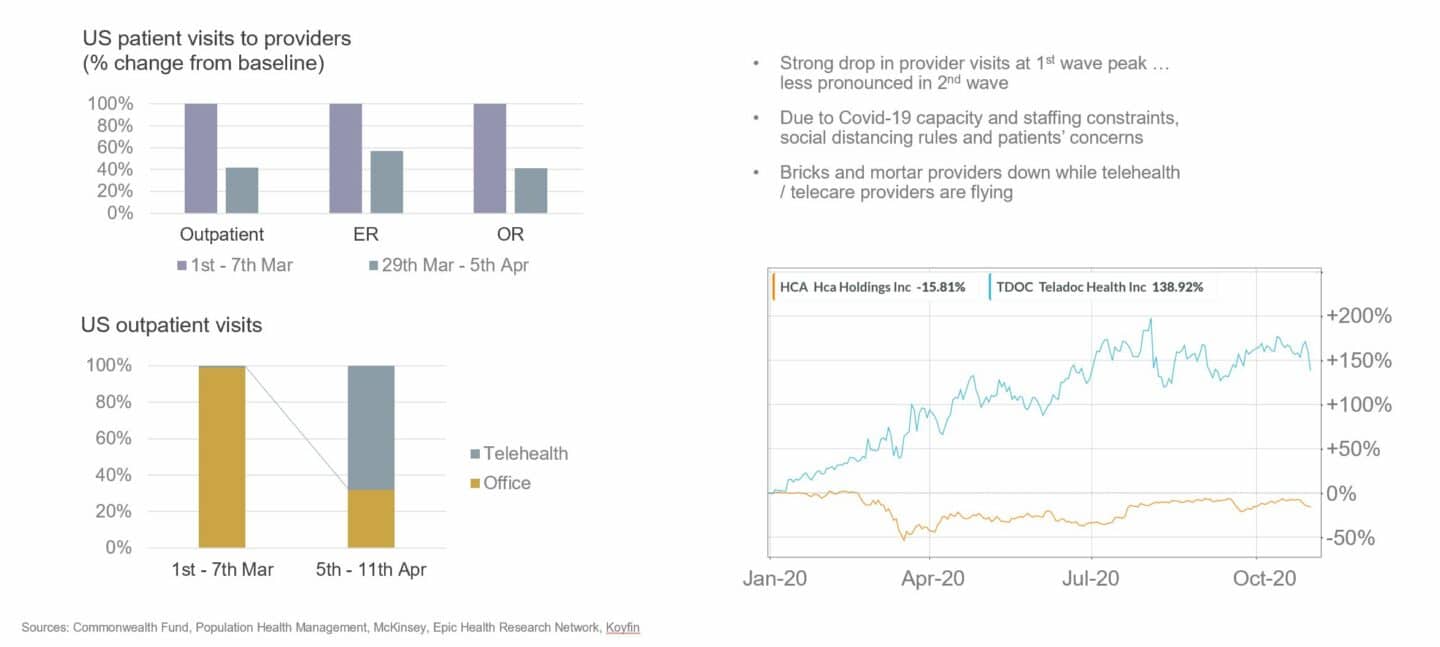

It’s these forces that are the catalyst behind the rapid rise of digital technologies in healthcare. Faced with an existential crisis brought about by the acute strain on providers from Covid-19, rapid resource re-allocation on a massive scale, social distancing measures as well as patient concerns, the entire industry had to learn how to do things differently almost overnight. And it learned pretty quickly that technology holds the key to overcoming many of the challenges posed by the crisis. As a result, bricks and mortar healthcare providers suffered whereas healthcare technology companies thrived.

For example, outpatient / GP visits dropped by >50% at the peak of the first wave compared to pre-pandemic. At the same time, teleconsultations jumped from low single digit percentage points to almost 70%. Hospitals, which rely on elective surgeries to turn profits saw their finances deteriorate rapidly as operating room capacity was sacrificed for Covid-19 preparedness and non-urgent interventions postponed. This has created a significant backlog (hospital waiting times in the UK are at an all-time high with 5m patients waiting for treatment) that hospitals are trying to manage for example through the use of new / better workflow and surgical management software, again benefitting technology providers. Tech-enabled services companies such as Livongo and Omada in the US, and AlbionVC portfolio companies Oviva and NuvoAir in Europe that support remote monitoring and treatment of chronic conditions have flourished. Doctolib, an appointment booking company, is now the main platform behind the booking of Covid-19 vaccinations in France. The list of examples goes on and on.

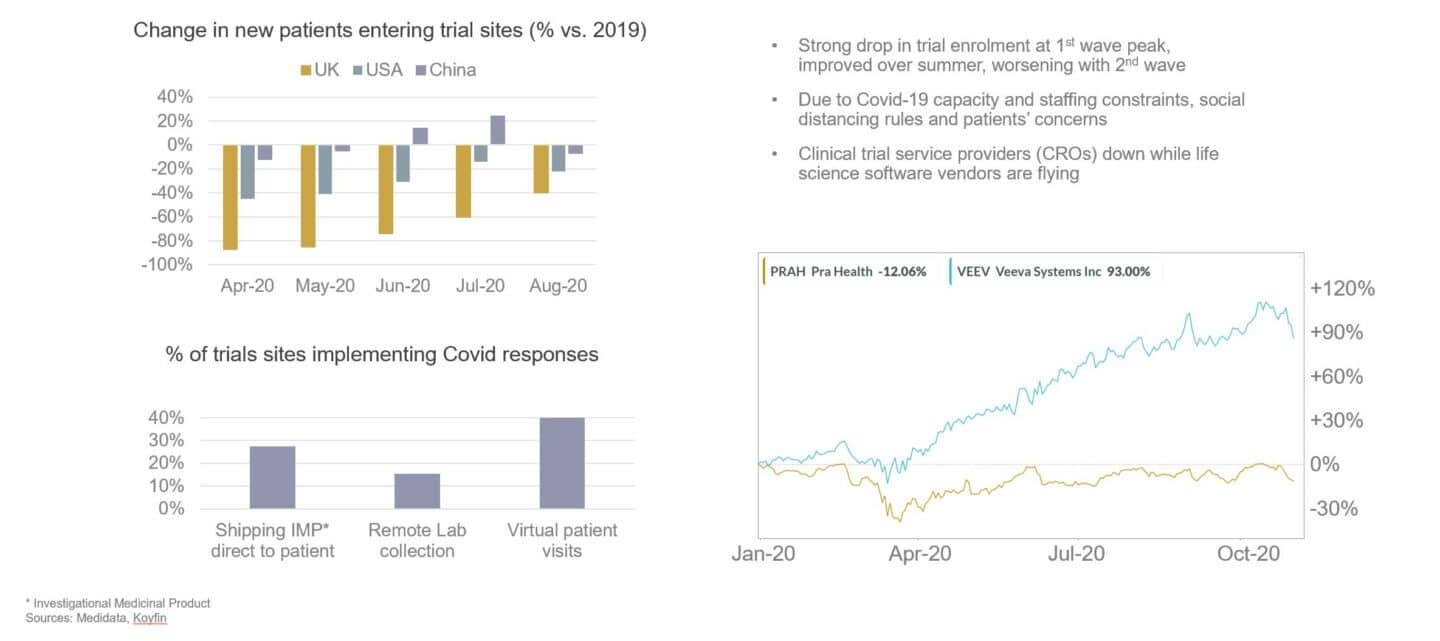

However, it’s not just GPs, hospitals and patients that have been affected. The pharmaceutical and medical device industries have had a rough ride as well. The worst-impacted part of the pharma value chain has been clinical development. Clinical trials typically require patients to visit hospitals or GP practices for enrolment and follow-up visits, however these sites had to severely restrict or stop completely their clinical research activities during the pandemic, both to focus on Covid-19 and to enforce social distancing. Clinical trial enrolment thus almost came to a standstill in the UK during the peak of the first and second waves. Clinical stage programs have received tens, sometimes hundreds of millions of investment from their pharmaceutical sponsors and can be worth billions in revenues so the industry had to find ways to adapt. The impact is also being strongly felt on the commercial side with sales reps struggling to visit prescribers and large industry events cancelled or moved online. The beneficiaries have again been technology vendors, in particular those that help move activities that traditionally happened face-to-face to remote. Technologies such as electronic patient reported outcomes (ePRO), eConsent and connected devices are being rapidly adopted over the last year. Companies that are successfully combining remote-enabling technologies in comprehensive decentralised or virtual clinical trial offerings have seen sometimes meteoric growth rates.

Exactly where we are going to end up on the healthcare digital technology adoption curve once the Covid-19 has been brought under control, nobody knows. The result will partly depend on how much longer the pandemic will impact healthcare systems and the need for continued social distancing. But one thing is clear already: there’s no going back to the old ways. Just as working patterns have changed for good throughout many countries in Europe and the USA, so has care delivery and clinical research. In a way, the healthcare industry has been lucky that mature technologies exist today that allow it to continue to function in a world of social distancing. Forced to adopt them, it is now realising the benefits these technologies confer beyond just moving meetings online on patient convenience, engagement and compliance, short and long-term health outcomes, efficiency and cost.

State of digital adoption in Healthcare in Europe

At AlbionVC, we have been investing in healthcare for 25 years and digital health for 15 years. When we started out, the opportunities were far and few between. While European healthcare systems are still behind the USA in terms of digital adoption, much has changed, in particular since Covid-19. There has been an explosion of entrepreneurial activity and an opening up of the markets to adopt new technologies and business models. There are now many digital health companies focusing on almost all aspects of the pharmaceutical industry value chain, healthcare providers and patients. There now are a number of digital health unicorns in Europe and more and more dedicated digital health or health tech funds are being been established (for example Heal Capital, Lauxera, DHV, Octopus Ventures).

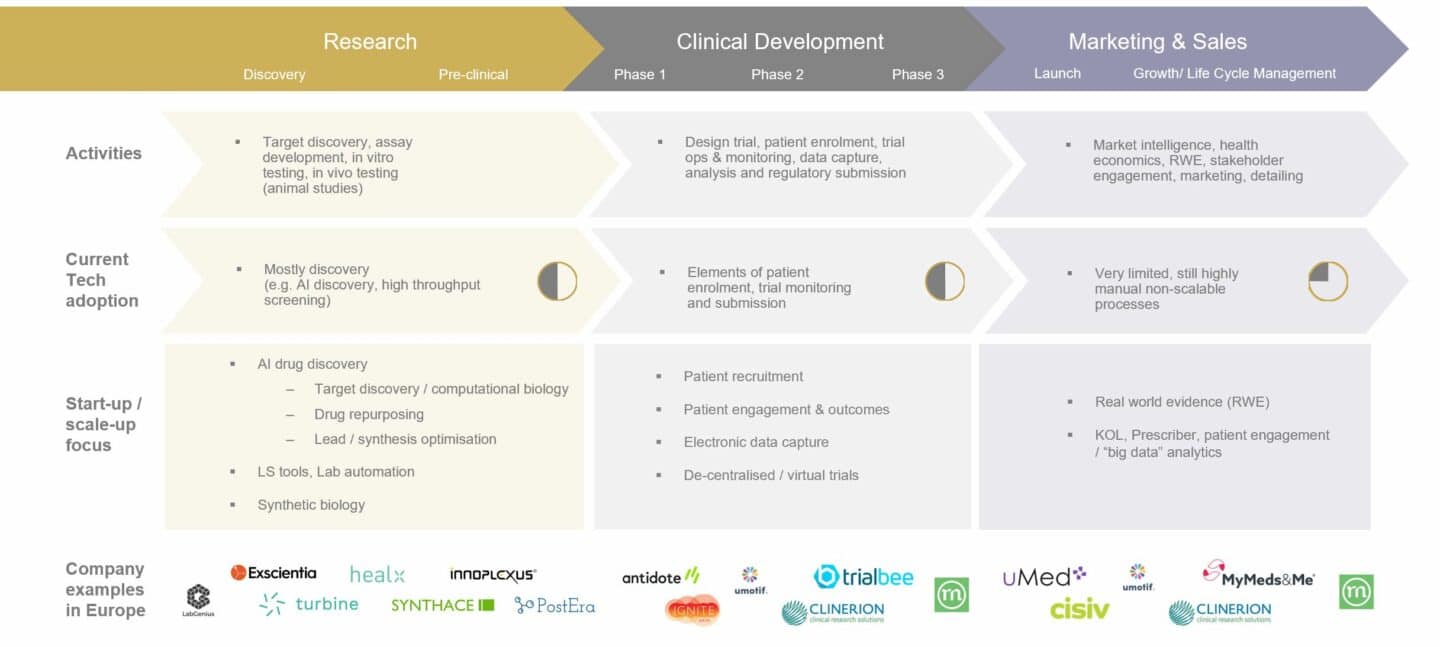

At AlbionVC we mostly invest in B2B companies and focus our digital health activities on two customer segments: the pharmaceutical industry (Digital Pharma) and healthcare providers (Digital Care). Looking at Digital Pharma first – the graphic below, which shows the value chain for pharma, provides our view of the state of technology adoption and where we see most start-up / scale-up activity in Europe today.

The first part of the pharmaceutical value chain that saw strong adoption of digital and the creation of the first large pharma software companies was clinical trials with the rise of electronic data capture (EDC), which, to this day is dominated by American firms such as Medidata (recently acquired by Dassault) and Oracle (who bought Phase Forward). This was followed by the digitisation of patient reported outcomes (ePRO), eConsent, and using digital tools to help with patient recruitment and engagement (all of these now often lumped together as de-centralised trial technologies). Clinical development is the largest segment in terms of revenues by pharma technology vendors and we expect it to continue to grow strongly following the leapfrog that happened with Covid-19. A segment that’s still underpenetrated but where we see lots of potential for growth in digital is marketing & sales, incl. so-called real world evidence research (RWE). A lot of the digital companies in that segment are using modern analytics tools such as AI on large medical and non-medical datasets to extract insights that are useful for things like drug safety, label expansions, cost-benefit ratios, market access and sales force effectiveness. The “hottest” segment at the moment is all the way “upstream”, i.e. early-stage pharmaceutical research and the many start-ups trying their luck with AI drug discovery. While it receives a lot of interest and there have been some notable successes (e.g. Exscientia in the UK), the size of the segment in revenues generated from the sale of digital technology is still small. In fact, most start-ups focus on creating their own pipeline or realising value by licensing IP to larger pharma companies. We will publish a lot more detail on these segments, their trends and where we see the big opportunities for start-ups and investors in the future.

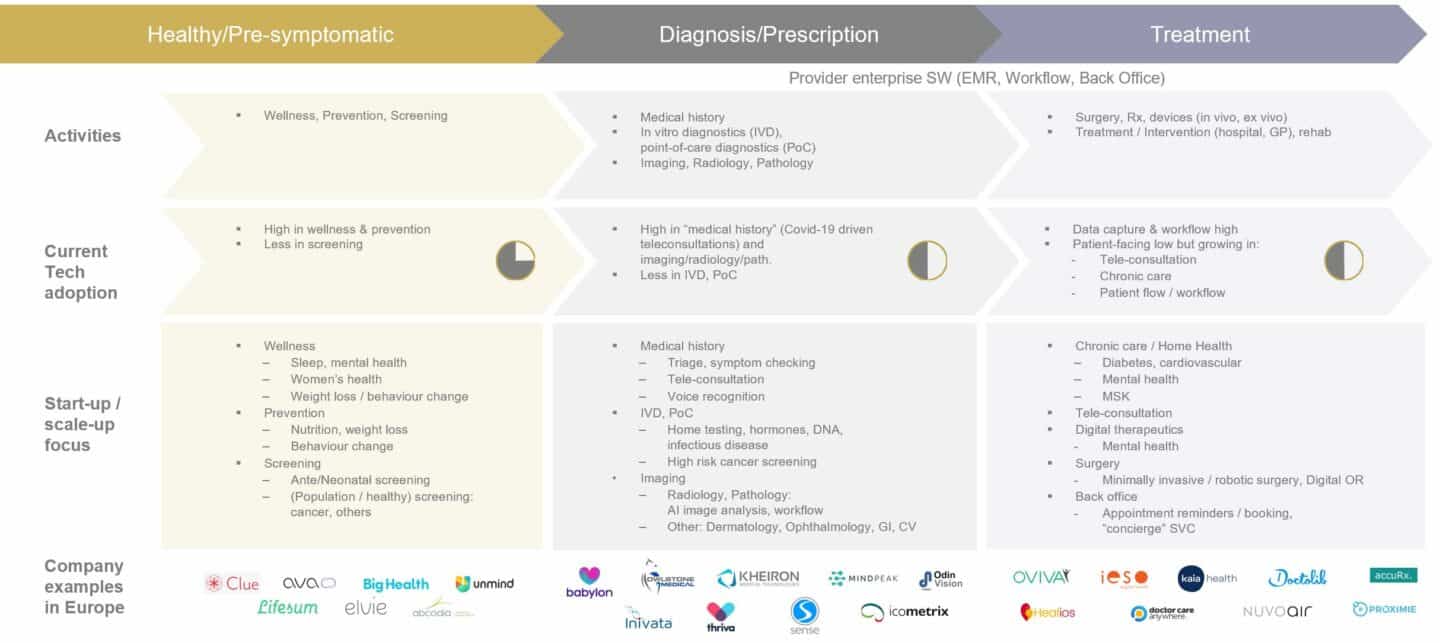

Now turning to Digital Care – the graphic below shows a very simplified patient-provider journey with our view of the state of technology adoption and where we see most start-up / scale-up activity in Europe today.

First to digitise in the hospital were the picture archiving systems (PACS) in the radiology departments. This was followed by the widespread adoption of electronic medical records (EMRs) and patient administration systems, which, surprisingly, only really happened in the first half of the last decade. At about the same time, many departmental workflow IT solutions (e.g. laboratory information systems or LIS, Radiology Information Systems) were rolled out across hospitals in Europe. Today, this is quite a mature and fragmented market with most larger European countries having their own national champions for secondary and primary care IT solutions (except perhaps the UK hospital EMR market, which has been rolled up by American firms). Most recent digital start-up activity has however been in consumer- or patient-facing applications such as apps for meditation, mental health, female health, weight management, etc. Most companies in this category follow the usual B2C model and are comparable to other non-healthcare/wellness focused apps, though more and more are now also selling to employers, following a trend that started in the US about a decade ago. Another category that has seen strong growth, in particular following the onset of the pandemic is teleconsultation with companies such as Babylon or Kry, most of which also operate B2C models. The third and, we believe the one with the biggest potential to transform healthcare, is digital care with companies such as Oviva, Kaia or Healios focusing on chronic care and which are primarily B2B businesses where solutions are delivered remotely.

In summary, a lot has happened in health tech in Europe over the last decade and the industry is currently witnessing a quantum leap brought about by the worst pandemic in generations and driven by a growing number of trailblazing entrepreneurs that are helping healthcare adapt and change for good.

If you are one of those and are building a company in health tech in Europe and the UK, we’d love to hear from you hello@albion.vc.